excise tax rate nc

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

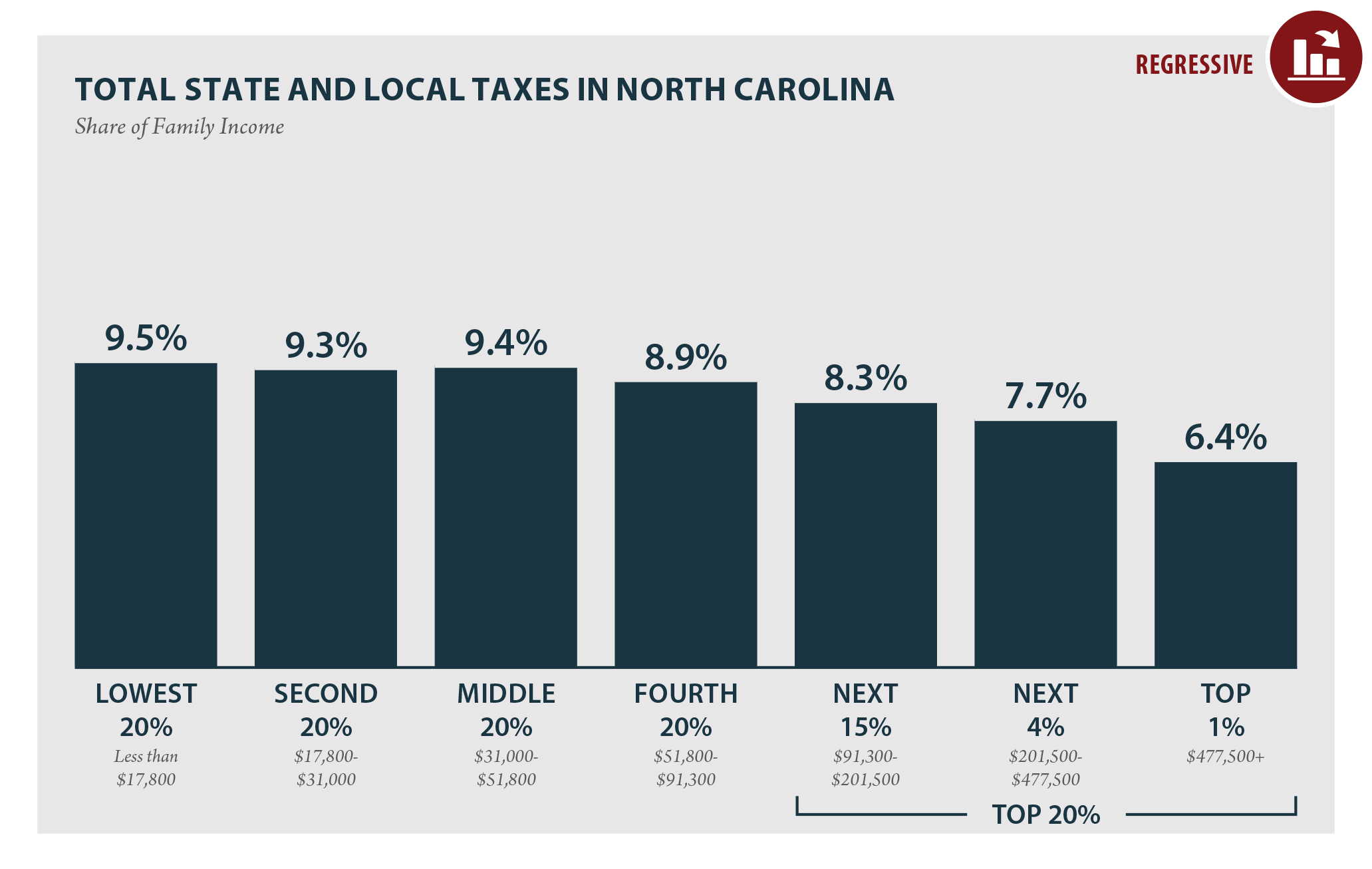

Low Income Taxpayers In Nc Pay More Of Their Income In State And Local Taxes Each Year Than The Richest Taxpayers The Pulse

North Carolina has a 475 percent state sales tax rate a.

. This is basically a sales tax from the state on selling the house. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. The tax rate is one dollar.

This title insurance calculator will also. Excise Tax Nc Calculator. How are Your Tax Dollars Spent.

Back to top Contact NCDMV Customer Service 919 715-7000. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax.

North Carolina County Tax Offices. 2022 North Carolina state use tax. North Carolinas general sales tax of 475 also.

What is the state excise tax rate. Exemptions from Highway-Use Tax. This means that when you sell your home you have to pay this tax at closing to the state of North Carolina.

2016 Piped Natural Gas Tax Technical Bulletin. For example a 600 transfer tax would be imposed. North Carolina has a flat 499 percent individual income tax rate.

North Carolina also has a 250 percent corporate income tax rate. 2013 nc tax expenditure database. 105-11380 and 105-11383 ncleggov or contact the Department of Revenue.

The NC use tax only applies to certain purchases. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Appointments are recommended and walk-ins.

The tax rate is one dollar. NC Register of Deeds tells us that we have to pay something called an excise tax when selling your property. The way that you can compute this is by multiplying the selling price of.

The North Carolina use tax is a special excise tax assessed on property purchased for use in North. Since excise taxes can be levied by the feds the state and the city they can add up certain items. Returning to the District of Columbia local cigarette-specific excise taxes are.

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Who is responsible for paying the state excise tax. Imposition of excise tax.

Excise tax on conveyances article 8e of chapter 105 of the north carolina general statutes general information excise tax is a state tax computed at the rate of. 2016 Alcoholic Beverages Tax Tehcnical Bulletin. Customarily called excise tax or revenue stamps.

Imposition of excise tax. Vehicle Property Taxes. North Carolina Beer Tax - 062 gallon.

200 N Grove St Hendersonville NC 28792. 2016 Privilege License Tax Technical Bulletin. In North Carolina other tobacco products are subject to a state excise tax of 1280 wholesale price as well as federal excise taxes listed below.

North Carolina applies a 005milliliter tax. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

Excise Tax on Conveyances Article 8E of Chapter 105 of the North Carolina General Statutes General Information Excise Tax is a state tax computed at the rate of 100 on each.

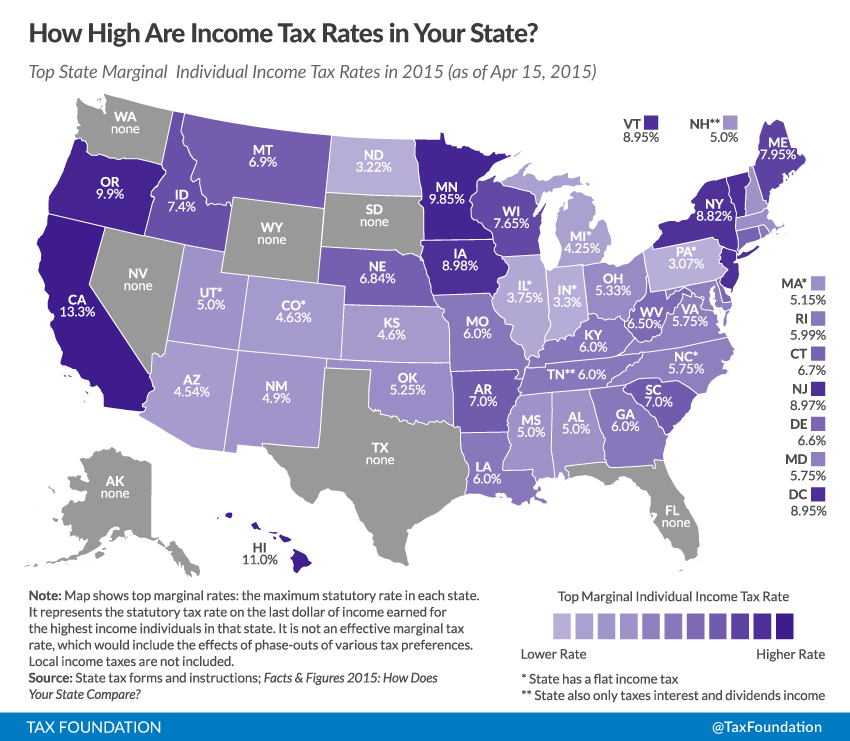

North Carolina Tax Reform North Carolina Tax Competitiveness

How The Tax Cuts And Jobs Act Is Helping North Carolina Americans For Tax Reform

North Carolina Budget Compromise Delivers Further Tax Reform Tax Foundation

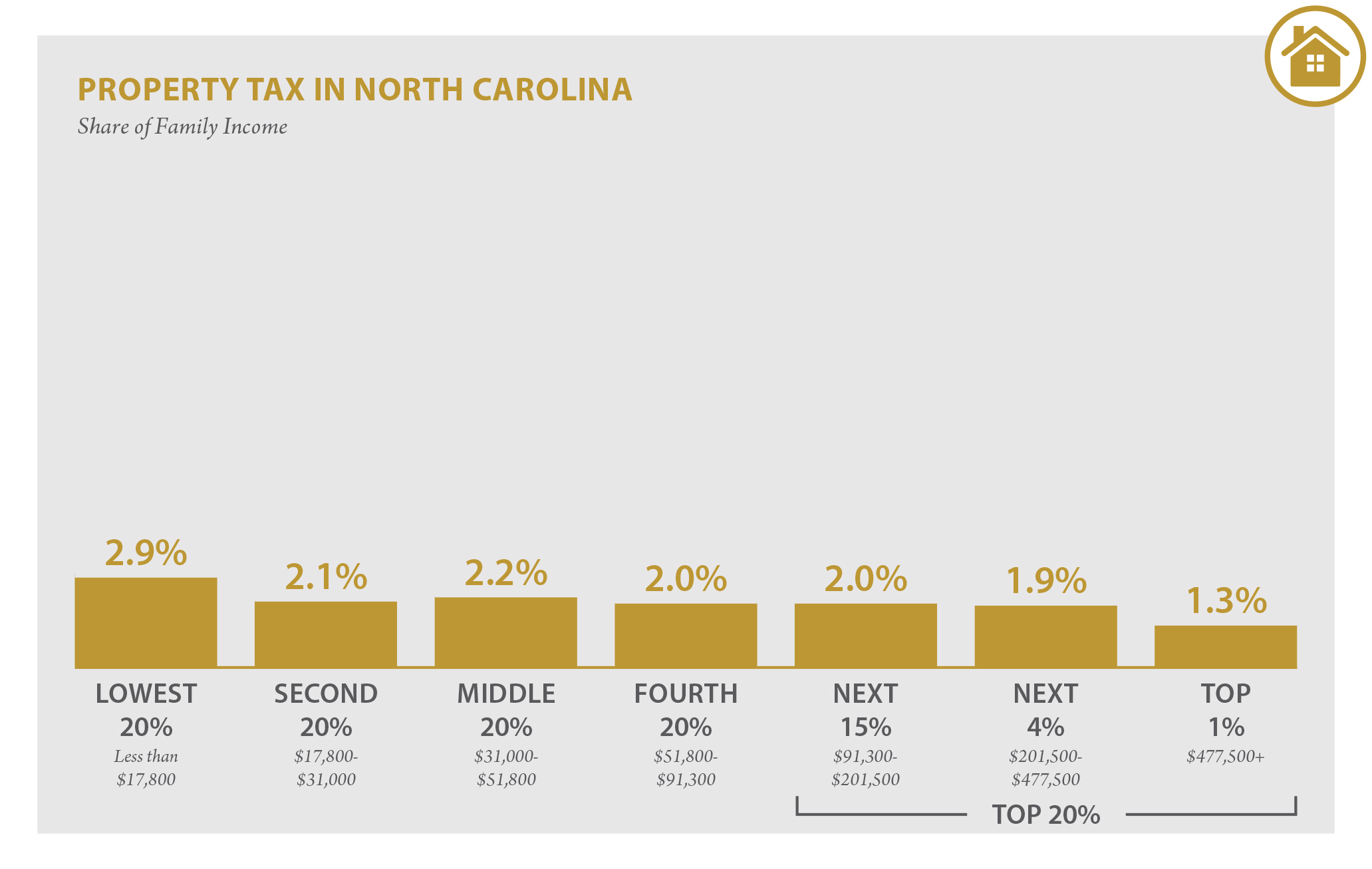

North Carolina Who Pays 6th Edition Itep

North Carolina Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Historical North Carolina Tax Policy Information Ballotpedia

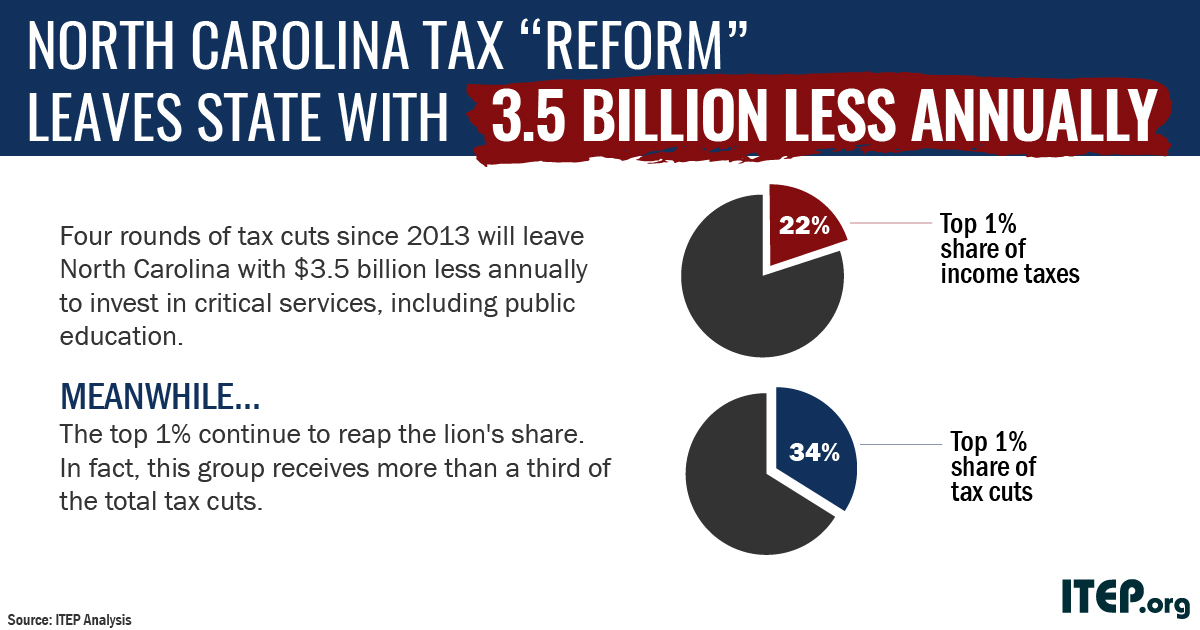

Nc Teachers March On Raleigh And The Tax Cuts That Led Them There Itep

Fssai Registration Get Fssai Food License Online Lawyerinc Food License Food Safety Certificate Certificate Templates

Taxes Incentives North Carolina S Southeast

North Carolina Budget Compromise Delivers Further Tax Reform Tax Foundation

Wake County North Carolina Property Tax Rates 2020 Tax Year

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nc Teachers March On Raleigh And The Tax Cuts That Led Them There Itep

North Carolina Who Pays 6th Edition Itep

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

North Carolina Sales Tax Small Business Guide Truic

North Carolina Tax Reform North Carolina Tax Competitiveness